COVID-19 & Market Update - 22 March 2020

22 March 2020Mint Client Update – COVID-19

Mint Operations Update:

As from Tuesday the 24th of March 2020 all Mint staff will be working remotely from the office given the recent announced changes that have been implemented by the New Zealand Government. Please be assured we will carrying on with our normal business activities. If in the meantime you would like contact us please click the link at the bottom of this article.

The Environment

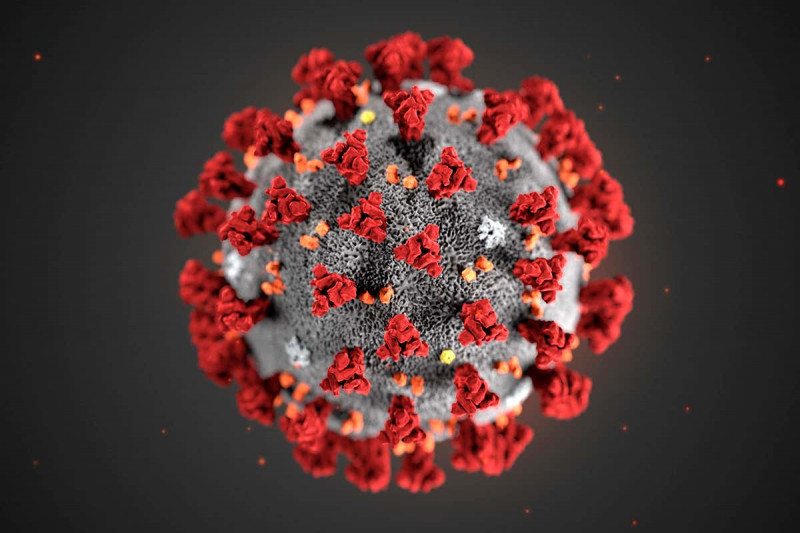

Well it has all been said really. With the plethora of articles and information that has bombarded us over the last few weeks, you know as much as we do about Covid-19 and the policy responses here and abroad. We have seen Governments and Central Banks around the world delivering somewhat uncoordinated stimulus responses, which in turn are slowly getting bigger and bigger as each day passes.

These actions have given companies no time to respond, manage and plan for the impacts on their business of border closures, reduction of gatherings and physical distancing. Naturally, companies are looking at and implementing their key levers to reduce their spending and cut costs, which of course includes jobs.

A classic example is Air New Zealand. With the government forced to impose stricter and stricter border controls and travel policy, Air NZ’s revenue is curtailed – for a wholly unknown period. The company still has costs though and naturally, they turned to their majority shareholder for help in these unprecedented times. Note: unprecedented. Air NZ is a very well run airline and a critical part of our nation’s economy and transport infrastructure; only a few weeks ago a bailout requirement was unthinkable. No company though, however well managed, would have had an instant plan available to deal with this situation. Now, Air NZ can adapt; but they need time to do so, not least so they can try and avoid letting go of too many of their staff. The government did respond to Air NZ’s distress call – albeit the facility includes high interest rates and equity conversion options; so, help is there if needed but it is not cheap.

This is not an economic problem for the Reserve Bank to fix. The central bank’s role will be to cushion the economic impact (cutting the OCR – done) and to manage the financial system and liquidity availability (which they are doing). They will probably move to quantitative easing (actually as we send this note, they have moved to QE); but the main effort to make the economic downdraft as shallow as possible must come from the fiscal authority. This, after all, is why NZ governments run disciplined budgets – effectively saving the fiscal balance sheet for a rainy day. Well, the summer is over, and it is now a rainy day.

So what has Mint been doing?

In broad terms we are following our investment process and leaning heavily on the experience the Mint team has built up over many years (it sounds trite, but it is very true). We are identifying businesses with long-term sustainable cash flows that can grow through the economic cycle. We are adding to those holdings and we are reducing holdings where the world has changed – i.e. where we think the current phenomena pose a higher risk to their cash flows than was apparent only six weeks ago.

At the same time though, we are running higher levels of cash than normal as we think earnings growth for the period immediately ahead will be as rare as hen’s teeth.

Australasian Equity Fund

Cash levels remain high for this fund and have been since January this year. This was not because we had a crystal ball, but because our processes and price disciplines led to us having more cash than we would normally expect due to the strong rally through 2019 and into January this year.

During mid-February and early March, we did reduce the cash levels very slightly as the fund started buying into market dips. Buy-the-dip has worked so well for so long that it was difficult indeed not to do so; however, we moved very slowly because we were really not sure just what Covid-19 would do. Since then of course many companies risk profiles have rapidly changed, which has caused us to rotate away from companies with higher risk profiles and reallocate those funds into our higher conviction stocks. So we are underweight Tourism stocks (including the Airport) and Retirement Villages and overweight in A2, Spark, Meridian and CSL. Because we have been actively rotating holdings, cash levels have remained relatively high. If we get a bear-market bounce, or a sudden resolution to the economic slowdown in front of us, then our fund will not keep up with a market rally in the short term. However, we would rather be late to a rally this time given the rapidly changing world in front of us.

Australasian Property Fund

Normally in volatile and risk averse times, the property sector tends to benefit and is seen to be the defensive, quality income investment of choice. An extremely low interest rate environment is also very supportive of investors’ appetite for high yielding property entities, and also provides a tailwind to debt costs. But not this time; and Australian property securities have been hit even harder than NZ ones so far.

Rationalising why this isn’t the case this time is particularly perplexing, but there are some important factors that might help to understand why. Firstly, property as a sector, had an incredible strong run in 2019. Partly driven by falling interest rates, and investors looking for better yields than they could get from term deposits.

It is a sector that has some gearing (albeit nowhere near as much as it used to have), and the current changes around self-isolation and reducing the size of groups are being priced into the market as a potential risk of lower future rents. On that basis, the sector hasn’t felt that defensive at all. However, for now it is a fear of future lower rents that is driving things.

Like the Australasian Equity Fund we have higher levels of cash and again have been rotating into stocks that we have a higher conviction in.

Diversified Growth

As the Coronavirus started to unfold we hedged 20% of the equity exposure using futures contracts, reducing our growth assets exposure to 65% from 85%.

We are invested in companies with strong balance sheets and good cash flows. These tend to be large cap stocks with great liquidity. The fund currently does not hold any Banks, Oil or Tourism stocks. Sectors we favour at the moment include Healthcare and Technology.

The current asset allocation of the fund is now sitting at 75% growth assets and 25% income assets with around 60% of the growth assets in global stocks. The effective growth exposure (after including the hedge) is 55%.

Diversified Income

The same approach was taken with hedging as we did for the Diversified Growth Fund, although for the Income Fund we fully hedged out the global equities, and the hedge remains in place. We have used futures as the hedging instrument (rather than selling physical securities) because we are confident in the assets we have invested in and we don’t want to unnecessarily incur any costs of selling the physical assets.

The current growth asset allocation of the fund is 21% with Property and Australasian equites making up approximately 11% of the growth assets. The effective growth exposure (after including the hedge) is 12%. On the income side of the fund the portfolio has 37% of cash. When the Bond market rallied to very low yields we took the opportunity to reduce our bond holding to 42%.

A side effect of tactically increasing the cash allocation is that we are effectively diluting the yield temporarily (i.e. cash yields are lower than anything else is). The benefit though is reducing volatility and preserving capital. Unfortunately, there is no hiding from a bear market and so negative returns are inevitable in the short term. The running yield of the fund currently is around 2.4%.

A final message

This is an evolving situation and we don’t have a crystal ball to anticipate how low markets could go and how long the unprecedented disruption to our daily lives will last. We will continue to update you as market conditions change, so you can continue to support your clients though these difficult economic times.

Most of our investment team have been around for several economic cycles and of course market events including the 1987 share market crash, the Asian Crisis and of course the GFC. The adage of “Keep Calm and Carry On” might sound a little flippant, but having clear processes and disciplines aligned with the combined investment teams knowledge allows us to do what we have always done through these times and concentrate solely on the financial outcomes of your clients.

Stay safe, keep well, and don’t hesitate in contacting us at if you would like further information.

Rebecca ThomasChief Executive OfficerMint Asset Management